Award-winning PDF software

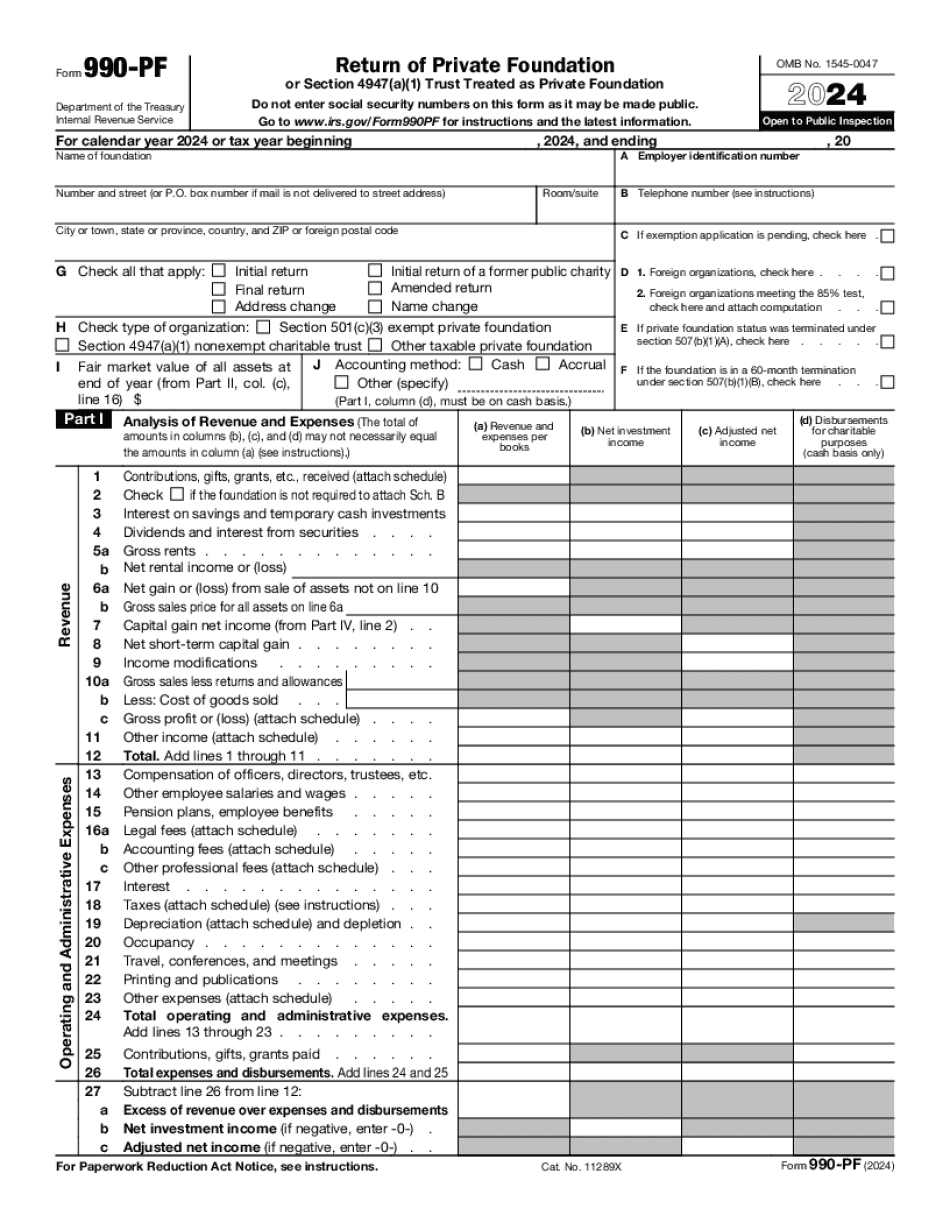

Printable Form 990-PF Florida: What You Should Know

We help nonprofit organizations keep their tax information accurate and comply with Florida laws. To search the latest tax information, click here. Florida | Department of State May 19, 2025 This instruction and the instructions it provides have been prepared by the Department of State in cooperation with the Florida Legislature, Department of Financial Services and Florida Tax Institute. This document summarizes state and federal tax-exempt organizations for purposes of complying with a proposed local tax-exempt legislation. The following is an explanation of the Department of State procedure for implementing a proposed local tax-exempt legislation (Article 12 of the Public Authorities Law of Florida). The following is a summary of the Department of State procedure, and the Department of Financial Services of the Florida Tax Institute's procedures. The following description of local tax-exempt legislation is a summary of Department of State procedures for implementing a proposed local tax-exempt legislation. The Department of State may publish the full text of a local tax-exempt legislation in the Florida State Register. This description is a summary of the Department of State procedures for implementing a proposed local tax-exempt legislation. The Department of State may publish the full text of a local tax-exempt legislation in the Florida State Register. For general information on State taxes on private, non-profit organizations and for the filing of Federal income tax returns see FL Dept. of Revenue Pub. 501. This publication, Florida Statutes § 101.151, provides general background guidance on the tax-exempt status of all types of nonprofit organizations. It is not intended, however, to be an exhaustive or complete set of state procedures to enable one to prepare and file a “return of exemption” or to obtain tax exemption. FL Dept of Revenue Pub. 501 — Guide to Form 990-PF Note: Some State agencies provide tax agency websites where users can view the forms required to be filed by each State agency. In the absence of such a link for a particular agency or a general description and contact information for the Tax Division, users are directed to the Federal Government's Bureau of Economic Analysis websites, which include state information at the same level as that required for use by the IRS. Users should use those resources to obtain the current versions of the required forms. Note: Many of the documents that we post on this website are in Adobe Acrobat. If you cannot use some documents, please contact us.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 990-PF Florida, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 990-PF Florida?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 990-PF Florida aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 990-PF Florida from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.