Award-winning PDF software

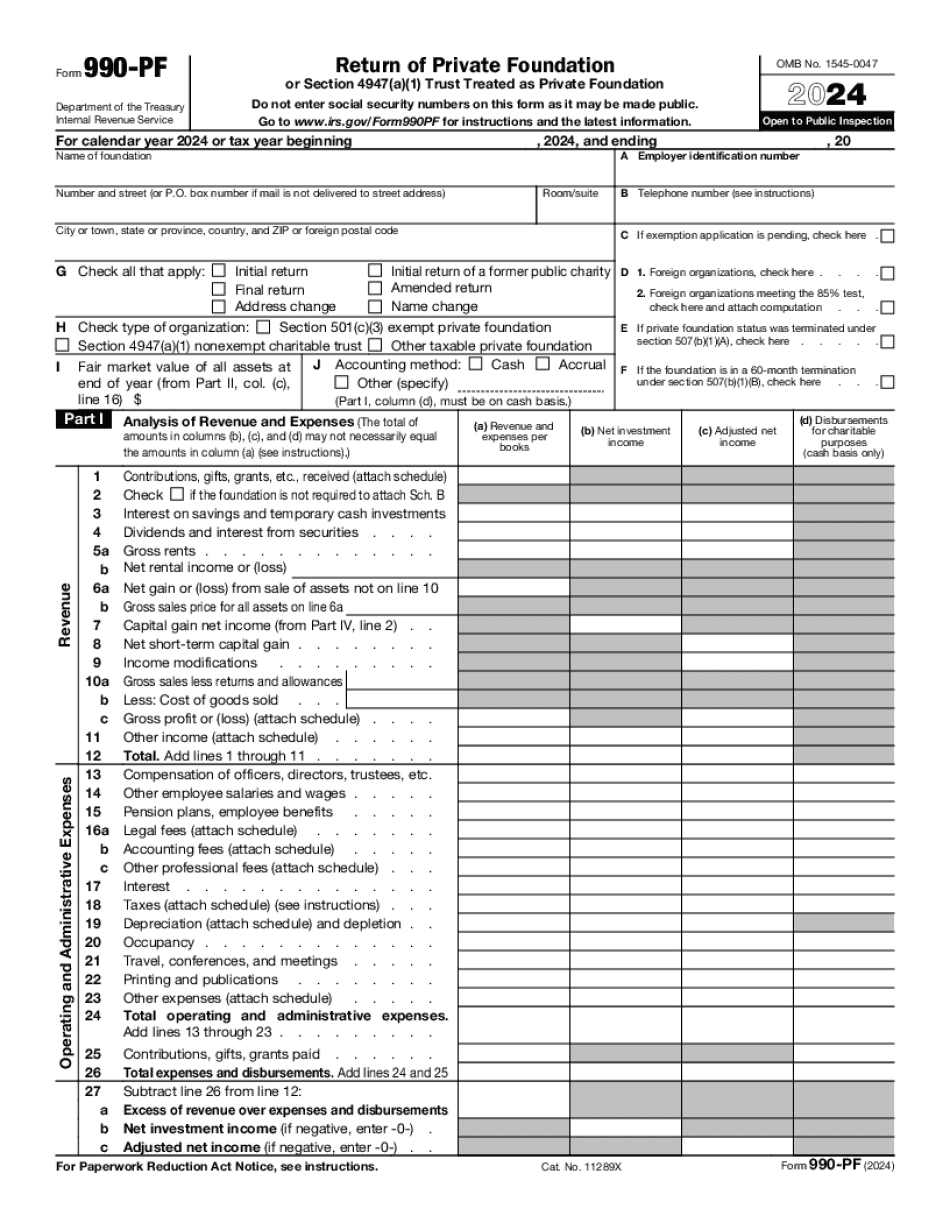

Form 990-PF for Maryland: What You Should Know

An Official Copy of A Form 990, 990-EZ, 990-PF, 590 Form 990-T, 590 Form 990-EZ, 590 Form 990 or 990PF, 590 Form 990, 990PF, 590 Form 990-EZ, 590 Form 990PF, 590 Form 990-EZ from a nonprofit corporation or from a state or commonwealth government. Maryland and all states and commonwealths require that non-profit corporations (501c4 corporations) must be established by individuals, and that the non-profit corporation and its directors, shareholders and officers shall be liable and responsible for all transactions of the non-profit corporations. The non-profit corporation shall be liable for the support or indemnification of its directors, directors' officers, shareholders' officers and employees (including officers or employees of their respective affiliates), its directors and shareholders' officers and employees of, or of any other person or persons related to, the non-profit corporation (in this definition, related persons refer to the owners of 10 percent or more of the beneficial interest in the non-profit corporation). Annual Form 990 From Public Charity Organization (a 501c3) Annual Form 990 From State Government (a 501c3) An official website of the Maryland Secretary of State. E-mails to us: A signed copy of the IRS Form 990. The IRS Form 990 requires a tax identification number that is issued under the instructions contained by the IRS in the IRS Form 990. E-mail that number to: IRSForm990maryland.gov. State of Maryland — Maryland State Charities & Non-Profit Corporation & General Fund A signed and completed form from a state or commonwealth government indicating that the non-profit's governing documents include a Code of Ethics. An official website of the Maryland State Charities & Nonprofit Corporation & General Fund. Details about Fuel Fund of Maryland — Maryland Public Charities If you are considering forming a nonprofit in Maryland, please go to our Start Your Maryland Form: IRS Form 990-N. Instructions:. Annual Form 990 — 501c3 from Government Organization — Maryland State If the form was filed with the Maryland State Government: A signed and completed form from a government organization indicating that the non-profit's governing documents include a Code of Ethics.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 990-PF for Maryland, keep away from glitches and furnish it inside a timely method:

How to complete a Form 990-PF for Maryland?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 990-PF for Maryland aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 990-PF for Maryland from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.