Award-winning PDF software

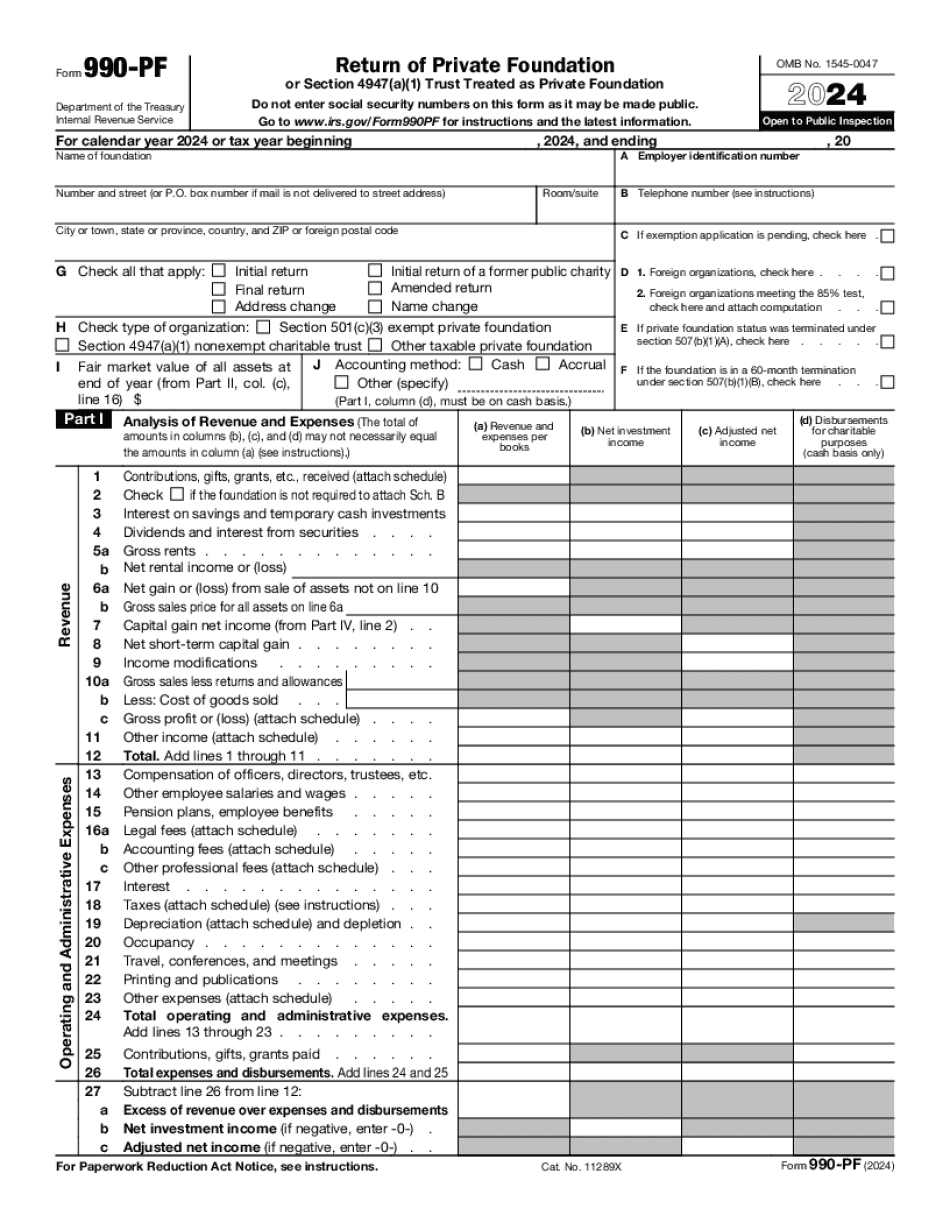

Tarrant Texas online Form 990-PF: What You Should Know

Ii) Any partnership or limited liability company with more than five (5) members. (iii) A corporation or other entity with more than five (5) shareholders. (iv) A limited liability company with more than fifty percent (50%) of its shares held by (or on behalf of) its employees, their spouses, or each member of their immediate families. (v) Any other organization with more than five (5) members. The table below provides examples of other organizations in which the term “sally” or an “eight” party can be applied. If the table below is not clear from the preceding, the following explanation should assist: A “sally” or an “eight party” is identified as having a board of directors composed entirely of females (women). In addition, the women's center is an entity that provides women, regardless of race, and their children, with an array of educational opportunities. A “she” is identified as having a board of two (2) and one (1) female members. All members of the board of directors has one (1) of three skills: (i) Leadership. (ii) Expertise in the field of women's advancement. (iii) The ability to lead a team. The Board of Directors comprises five (5) representatives who are determined by the Secretary of the Board of Directors to be women, and seven (7) representatives who are determined by the Secretary to be representative of female professionals. (b) A Form 990-EZ or 990-PF form or e-file for the organization is required for every member of the immediate family (that is, a spouse, child, parent, grandparent, sibling, grandchild, grandparent of those listed above) of each such individual. A Form 990-T application is required for every organization with more than five (5) shareholders.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Tarrant Texas online Form 990-PF, keep away from glitches and furnish it inside a timely method:

How to complete a Tarrant Texas online Form 990-PF?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Tarrant Texas online Form 990-PF aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Tarrant Texas online Form 990-PF from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.