Award-winning PDF software

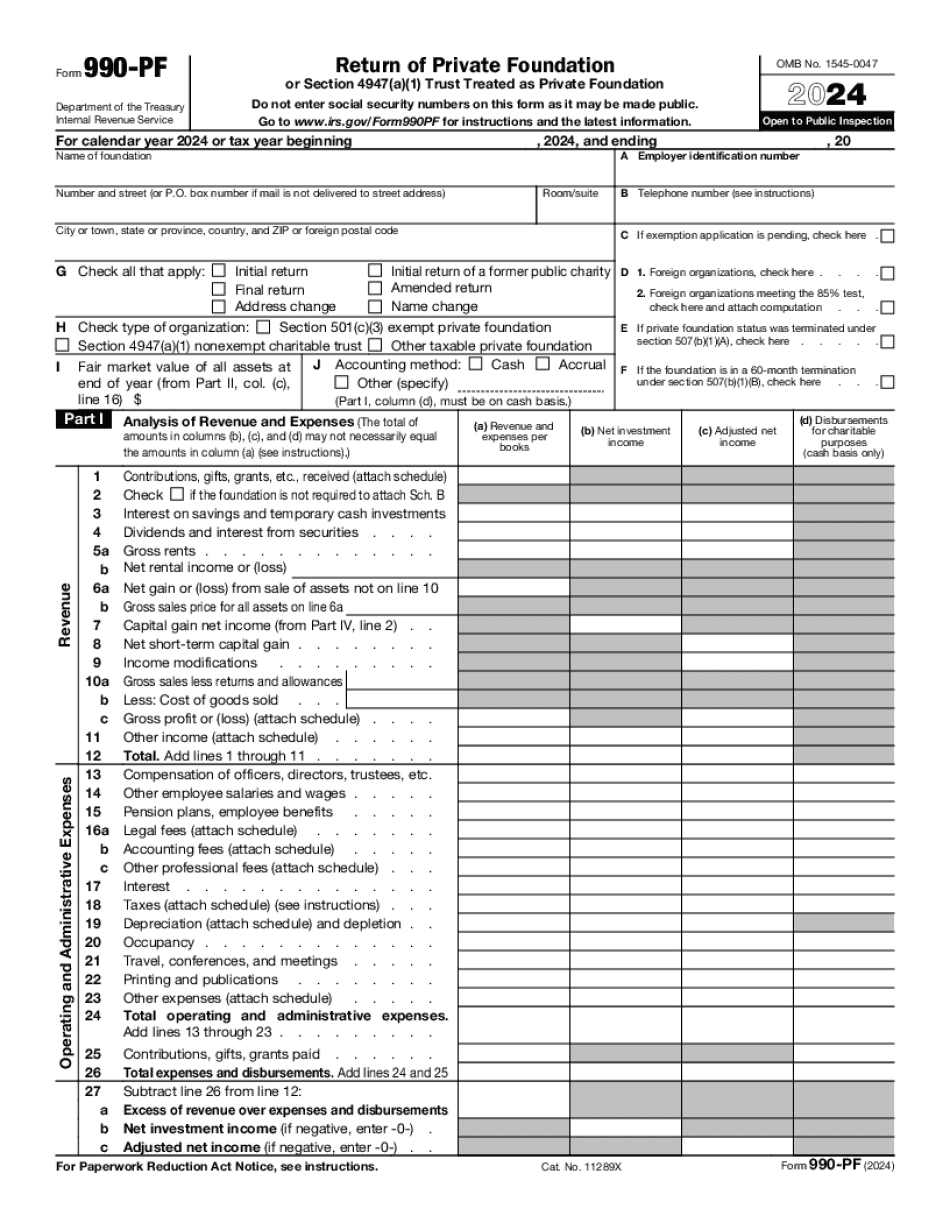

Victorville California online Form 990-PF: What You Should Know

Million for each violation. The form is due to the agency by noon on Wednesday, September 19, 2025 — or sooner if you want to save time. New form 990 is available online : Exemption Request — 5 per day for one filing location Permitted locations are the office of the Secretary of State, the United States Post Office Box, and United States Post Office, PO Box 2088 San Bernardino, CA 92; or a public library, a school, a non-profit group, or one of its members, as long as the organization is filing electronically; Individuals who are not required to complete Form 1120.pdf. Form 1120.pdf may be completed by submitting the following to the Public Advocate's Office, Suite 100 Building, 300 W. California Street, Suite 900, Oakland, CA 94612. Fax: An organization that knowingly files Form 1120.pdf with an incorrect TIN for a U.S.-headquartered office cannot be eligible for an exception. All Tins must be obtained. If you make an appointment to file an application within 2 years of a form 990 being filed, you are considered late. It will not be considered on a later application if the application is not processed within 6 years of filing a form 990 (unless there is another, valid reason for the delay such as the filing of the original form 990, an appeal by an earlier applicant, an unforeseen circumstance, etc.) Fee Exemption Request Form—20 per day If you do not wish to pay the fee, you may make an exemption request using the above form. You must complete and sign the form and fax it to the office of the New California Office of the Attorney General. Individuals who have been designated as disabled by a state, county, or city government may apply for an exemption from annual report filing requirements. Qualifying for the Federal Disability Tax Credit (TTC) The Federal Disability Tax Credit (TTC) is available to individuals who are disabled and who meet certain guidelines in the year they file their taxes. Individuals with income below 100% of FICA are eligible for the tax credit.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Victorville California online Form 990-PF, keep away from glitches and furnish it inside a timely method:

How to complete a Victorville California online Form 990-PF?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Victorville California online Form 990-PF aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Victorville California online Form 990-PF from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.