Award-winning PDF software

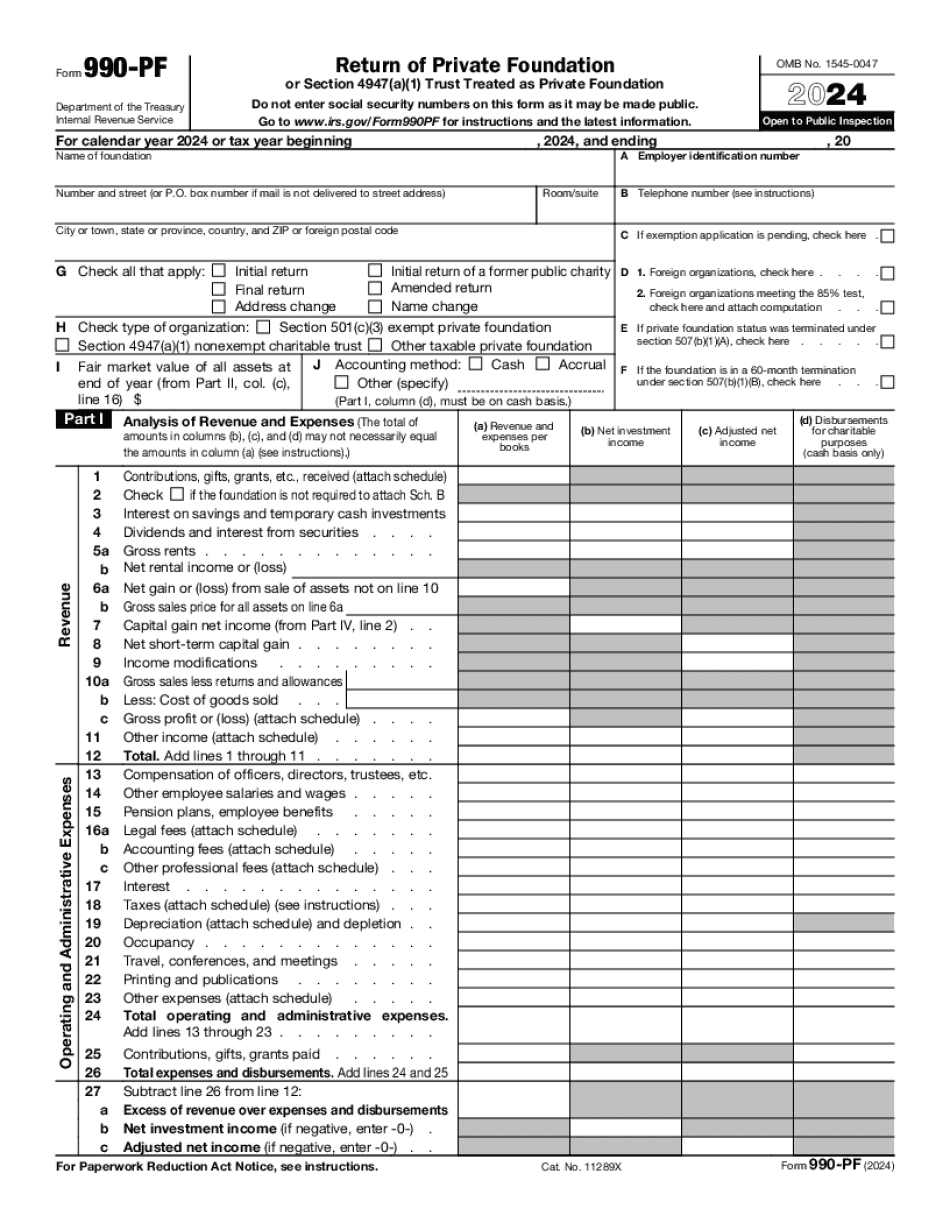

Form 990-PF Salt Lake City Utah: What You Should Know

Form 990. The City of Salt Lake determines the amount of tax that will be due. The State of Utah determines how much tax will be due. The IRS determines the amount owed to the IRS according to IRS Publication 535 (IR-535c). Utah Code: 4301-935-9. Examinations. Any person who has received a tax examination for tax liability arising under this title shall file an answer within 30 days of the date of such examination, except that the answer or response and any attachments thereto may be filed with the tax examiner only to the extent provided in this section or in Section 9-401.3 of this title. A failure to file a timely answer or response constitutes a default under this section. A penalty may be assessed against a taxpayer for failure to file an answer or response. Sec. 9-403. Failure to file statement of program service responsibilities. Failure to file a timely response to an information request in accordance with Section 9-401.3 of this title, in the absence of reasonable cause, shall constitute a default under Section 9-402.3 and shall be a charge to the taxpayer. Any other tax obligation shall be payable only after the delinquent tax is paid. The City of Salt Lake may impose a late filing penalty of not more than 100 for any failure to file such statement and only if the failure to do so commenced after the effective date of this ordinance. The City of Salt Lake shall assess and collect the late filing penalty and interest, in addition to the delinquency tax collected in the same manner as delinquency tax. Sec. 9-403.2. Dissemination and public access. (a) Each organization shall make the organization's Form 990 available to the public not less than twice a year, and each statement of program service information shall be made available to the public in the same manner. All information required to be made available under this section shall, upon request, be made available to one or more individuals or groups to whom the organization has granted an exemption under Section 9-405.5 of this title. As used in this section, “public” means the public, whether members or prospective members have a right or a legal opportunity to view the information. (b) Each organization shall prepare a summary that includes a description of the organization's program service activities, program expenditures, and financial status, and a schedule that summarizes the fiscal year in which the statement is to be filed.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 990-PF Salt Lake City Utah, keep away from glitches and furnish it inside a timely method:

How to complete a Form 990-PF Salt Lake City Utah?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 990-PF Salt Lake City Utah aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 990-PF Salt Lake City Utah from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.