Award-winning PDF software

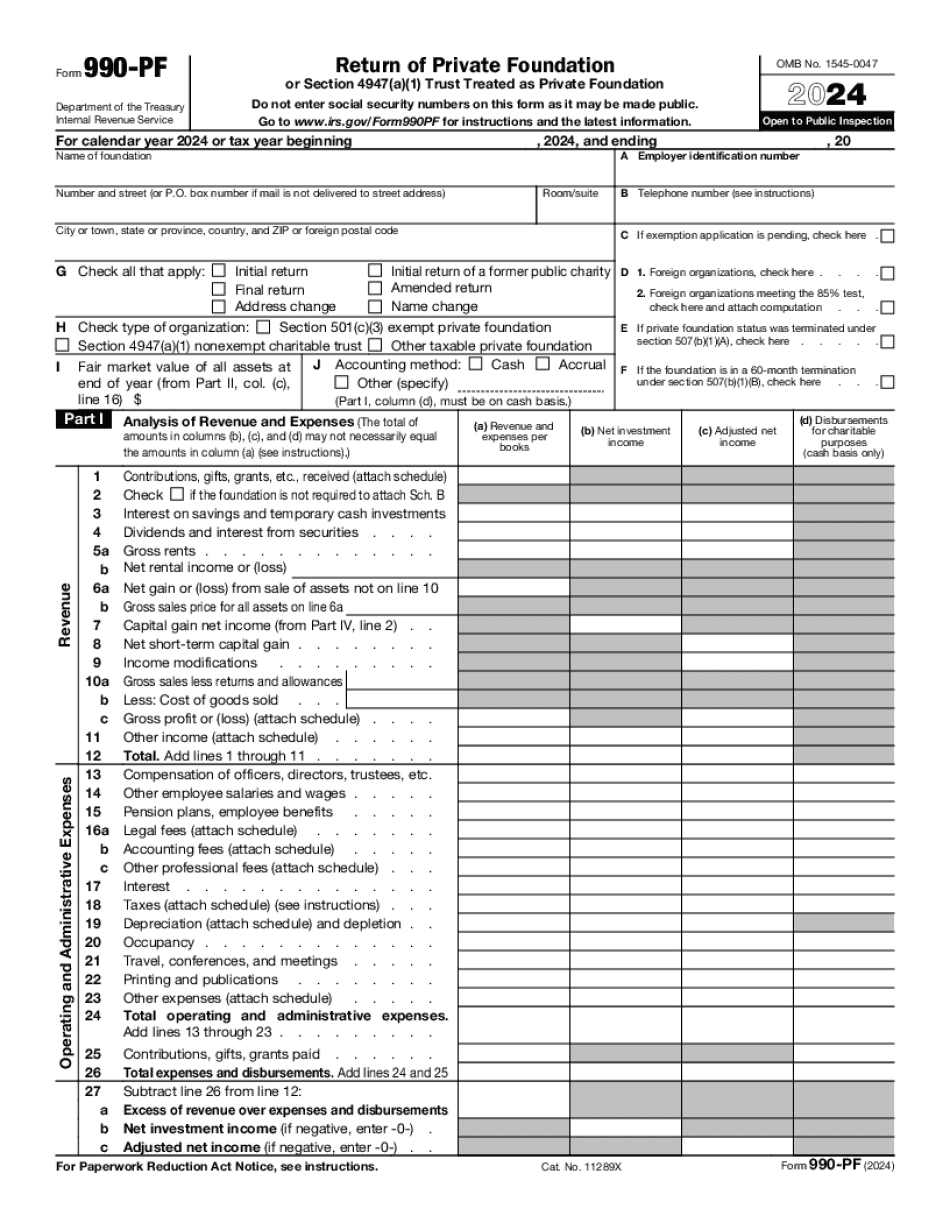

Form 990-PF for Thornton Colorado: What You Should Know

The forms are to be completed by the seller and completed by the buyer. The seller forms will need to be mailed to Thornton, CO by the following Monday (April 10th) in order to receive tax deductions. Items 16 — Registration & Tax Exempt Certificate: Each purchaser of any tangible personal property purchased by a taxpayer during the taxable year (January 1 – December 31) on a business (other than a limited liability company) must complete, sign and submit to the sales/tax officer a registration and tax-exempt certificate. The sales/tax officer will retain the receipt and the certificate for a period of three business days. The certificate shall be retained by all parties who are required to receive it and at the taxpayer's request. If it is not used by the purchaser during the taxable year, the certificate shall be returned to the Sales Tax Division with an original and a copy, and a copy attached to the return to be filed with the Colorado sales tax return. The sales/tax officer must maintain an index of the certificates and any other required sales/tax receipts. Items 17 -- Statement of Sale and Certificate: The salesperson or seller must provide a written statement of sale with item(s) of income, expenditure or loss. The forms will need to be mailed to Thornton, CO by Date: April 2, 2004, You may use your own signature to complete the written statement. You may use, but are not required to use, a form of personal identification such as the Social Security number, your state driver's license or a photo ID. Items 18 — Form 990-T, Tax Return — This is the return for individuals. The sale of tangible personal property to any purchaser who has not filed a federal tax return is taxable (to the purchaser). Form 990-T is also used when taxpayers purchase, trade, sell or give away tangible personal property or a computer to a third party. The purchaser can only deduct the sales price in one of three ways— cash price, purchase money or cost basis. If you purchase an investment property, you can deduct only the fair market value of the property when you use it against qualified investment income (but you must add back in that value the capital gain or loss of the loss). The purchaser's tax on the sale is not deductible.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 990-PF for Thornton Colorado, keep away from glitches and furnish it inside a timely method:

How to complete a Form 990-PF for Thornton Colorado?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 990-PF for Thornton Colorado aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 990-PF for Thornton Colorado from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.