Award-winning PDF software

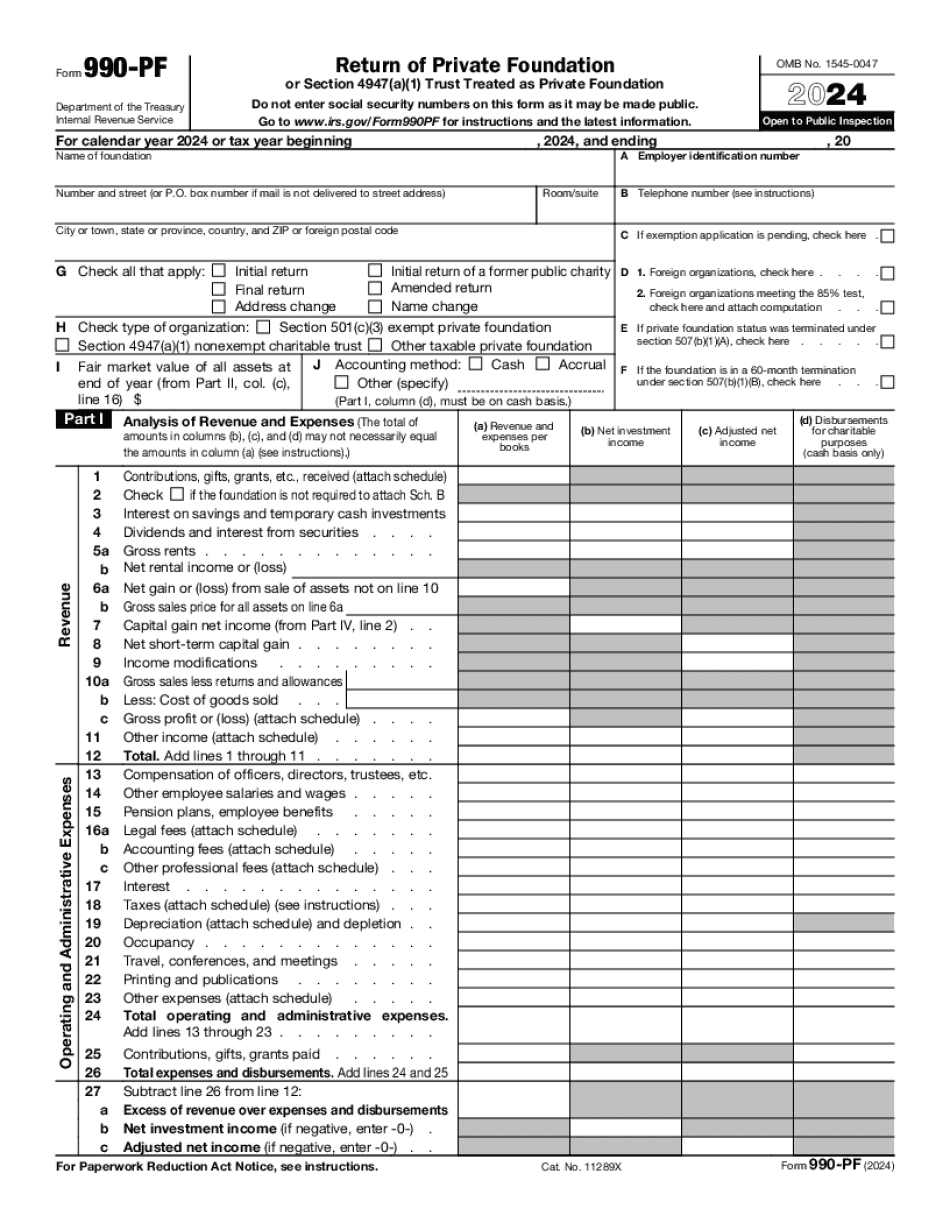

Form 990-PF for Moreno Valley California: What You Should Know

Learn about taxes You are able to view and manage the most up to date information on your nonprofit's IRS account. This way, you can focus on managing your organization and your donors and supporters. Tax Exempt Organizations List: More to Read The California Secretary of State, under the authority of California Business and Professions Code Section 22575 has designated as tax-exempt the following organizations: Housing Resources of the City of Los Angeles, Inc. Housing Resource of the City of Los Angeles, Inc. (HRC) is a 501(c)3 public charity organized under sections 501(c)3, 501(c)(1), 501(c)(2), or 501(c)(4) of the Internal Revenue Code. HRC accepts donations and grants in support of providing housing to needy and working poor residents of Los Angeles, California. The Corporation is organized and operated exclusively for religious and charitable purposes, not for profit. Its primary purpose is to provide housing to needy and unemployed homeless individuals. HRC is a nonprofit, tax-exempt community organization that receives tax-exempt donations for program assistance, including the provision of rental housing to clients who cannot afford their own homes. HRC conducts outreach programs, including those concerning housing assistance, to homeless persons primarily across Los Angeles. HRC conducts outreach programs to the homeless in the following areas: Hollywood, Santa Monica, Santa Monica Beach, and Los Angeles County. All persons making a donation to HRC are considered to be doing so to benefit the recipients of its services. HRC will only accept tax-exempt donations of money and property, as defined. By making a donation to HRC, the donor declares, in the written statement, that the donation is made or to be made for an exempt purpose and that the tax deduction claimed is not for a trade or business carried on by the person being given the donation. The IRS encourages charitable, religious, educational, and sporting organizations, as well as other similar organizations (such as chambers of commerce, corporations or labor organizations, and foundations), to consider the possibility that, as to their operations, they may be exempt from federal income tax. The purpose of the tax exemption is “to encourage the general welfare of the community, to promote social welfare in the community as defined by applicable federal administrative regulations, and to eliminate the effects of unfair competitive advantages that result from unfair or improper conduct in the community or from the use of a substantial part of the community's property and assets in unfair or improper ways.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 990-PF for Moreno Valley California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 990-PF for Moreno Valley California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 990-PF for Moreno Valley California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 990-PF for Moreno Valley California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.