Award-winning PDF software

990-n search Form: What You Should Know

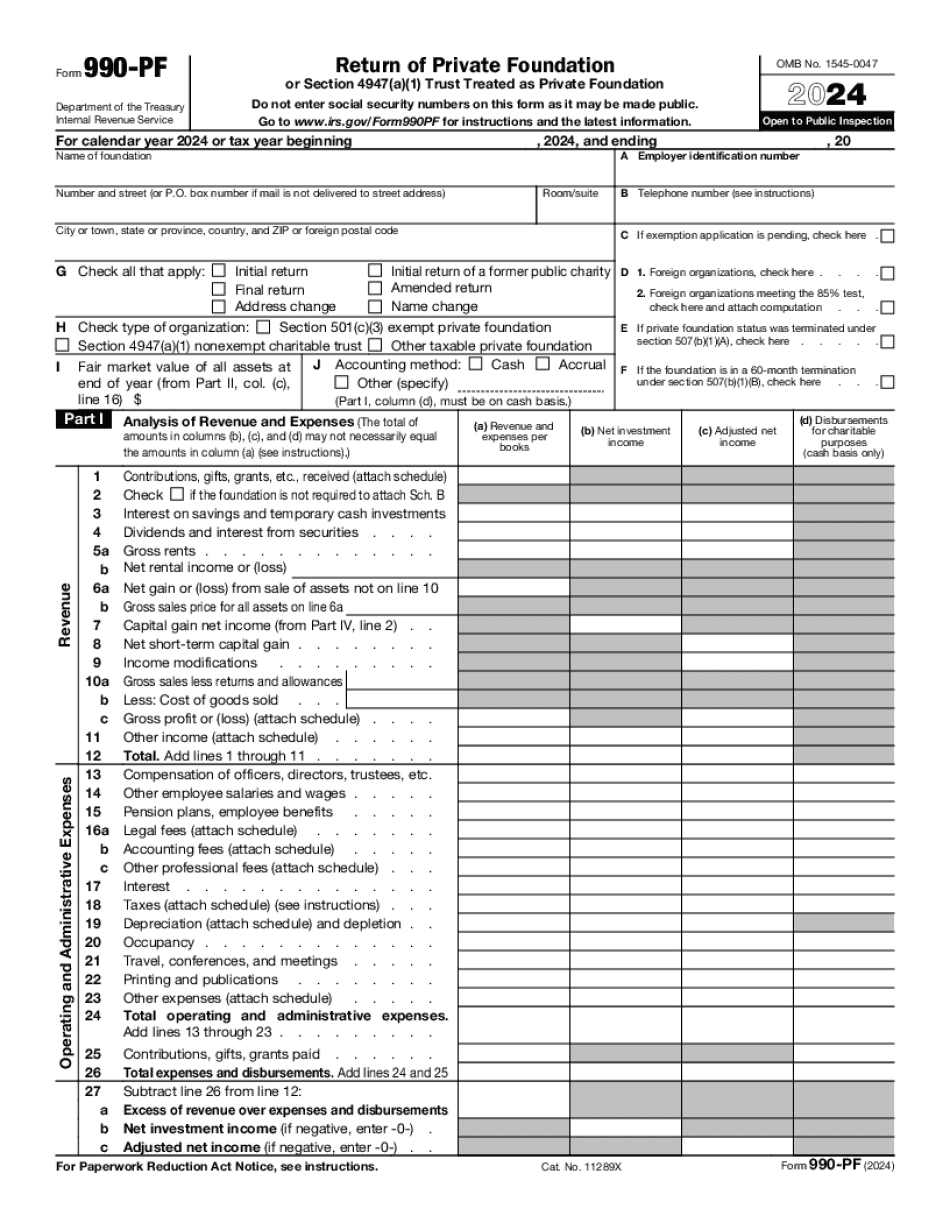

Tax-exempt organizations, including tax-exempt churches, must file their 990s electronically by providing the information directly to the IRS. In addition to Form 990 and 990-PF, the IRS provides other information about tax-exempt organizations via other forms that go into effect in FY 2018: Form 990-EZ and Form 990-PF — Federal and State Search the IRS Guide to 990-EZs and Postcards. Find the information you need by reviewing tax-exempt organizations' Form 990 reports. Learn about Forms 990, 990-EZ, and other IRS instructions for filing. The IRS offers training to its tax-exempt personnel on preparing 990 forms. Contact your local Tax Exempt Office for specifics on that training. Find the information you need by reviewing tax-exempt organizations' Form 990 reports, filing your own information requests with the IRS, and calling the IRS. Find information and guidance for each major tax form and the related FAQs. What if I want to get an electronic copy of a Form 990-N? If you have questions about obtaining electronic copies of Form 990-N or e-Postcards, please contact the nearest IRS office. What happens to a Form 990-N if the document I want can't be sent electronically? If the document you want doesn't have a digital/electronic image, Form 990-N will be sent to you by mail. You may request an electronic copy of the form by filling in and e-mailing Form 990-N in. If the document already has an image on it, it's sent to you as a hard copy or is scanned as a PDF. You can get the original document either by using our e-file system or by contacting the organization that filed the Form 990-N. Is the IRS processing my application for e-Postcard? No, the IRS does not process e-Postcard applications. Please contact the organization that received the original tax-exempt form for any special instructions. What if I already receive a 990-N or e-Postcard at someone else's address, and it has a broken or missing image? I want both my copy and the image. If the digital/electronic image is missing or corrupted, you might be able to get a copy from the organization that filed the form.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 990-PF, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 990-PF online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 990-PF by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 990-PF from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.