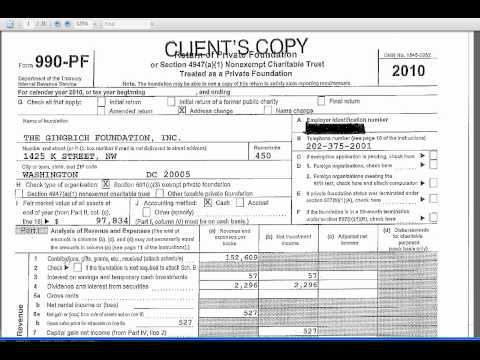

Former House Speaker Newt Gingrich recently released his 2010 tax return for his private foundation. A private foundation is a legal entity that is set up for some specific philanthropic purpose. A full copy of the return can be found on his campaign's website. The largest private foundation in the world is currently the Bill and Melinda Gates Foundation, with over thirty-eight billion dollars in assets. The speaker's foundation is just slightly smaller than that, with almost a hundred thousand dollars in assets. If we go to page two, we can see that the assets are made up of corporate stock and cash. On page one, we can see that the foundation received 150 thousand dollars in contributions for 2010. If we go to the detail on page 15, we can see that the sole contributor was Gingrich Holdings. Back on page one, we can also see that the foundation paid out 120 thousand dollars in contributions and grants. If we go to the detail here, the detail is on page 20, we can see a list of the recipients of the contributions. The biggest recipient was Luther College, which is in Iowa-where the speaker's spouse, Calista, went to school. The second largest recipient was the Basilica of the National Shrine in Washington DC, which is the largest Catholic Church in the country. Finally, the third largest recipient was the American Museum of Natural History in New York. On statement 6, we can see a list of the various board members of the foundation. They include the speaker's wife, Callista; Sonya Harrison, who is the executive director of the speaker's office; the speaker himself; the speaker's two daughters, Kathy and Jackie; and also the speaker's legal counsel, Stefan Possum Zeno. So that's the Gingrich return. Again, a full copy can be found on his...

Award-winning PDF software

990-pf Form: What You Should Know

Form 990 is a report that is prepared for you on a certain dates every year by an organization called a “private foundation” If you are an organization with a foundation, you must pay a registration tax of 7.65% for each calendar year on the amount which is the income and expenses of the foundation as it is reported to the IRS. Form 990 (PF) is a report that you can use to a) determine the income (net) to be received by the foundation from all sources How to Use Form 990-PF to Determine Your Tax Status and to Pay Your Registration Taxes Form 990-PF (PF) is a public record containing the name and residence of the foundation or nonprofit organization The forms are available online from the websites of the Internal and Exempt Organizations (EOS) (for the federal organization). Form 990 (PF) is a tax report used by the IRS to determine your tax status and the amount you should pay each year to the IRS for each taxable year. When Form 990-PF, a return of private foundation or Section 4947 (a)(1) trust is filed, the IRS prepares detailed records that identify your tax ability for every tax year you have had a private foundation or section 4947 (a)(1) trust as a foundation. Form 990-PF and the IRS are now on a collision course! (and I mean +1). The IRS says it wants to make it easy for you to find the most up-to-date information about your organization! “This form is available in your tax return for tax years 2009, 2010, 2011, 2012, and 2013. It is also available at all IRS Offices. You may review and file this form electronically online or by mail or in person.” Form 990-PF (PF) is the tax reporting document that you have to file when you have a private foundation or a section 4947 (a) (1) trust as a foundation. What is a private foundation? A private foundation (also called private foundation) is an organization other than a charitable organization for tax purposes.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 990-PF, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 990-PF online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 990-PF by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 990-PF from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 990-pf form