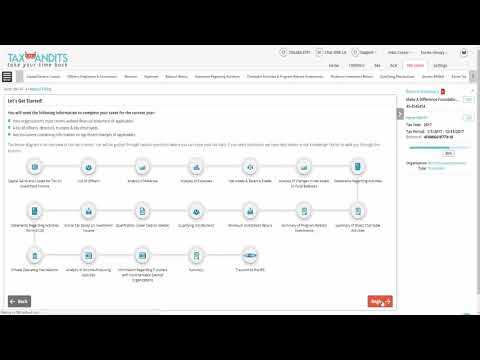

Welcome to Tax Bandits, the efficient filing platform for small businesses and nonprofits. The 990-PF is an information return filed by US private foundations with the Internal Revenue Service. This public document provides fiscal data, foundation names of Trustees and officers, application information, and a complete grants list. To start filing your 990-PF on Tax Bandits, log into your account and click on "990 Series" under "Start New Forms" on the homepage. Choose the 990-PF form and proceed to enter your organization details, such as organization name, form of organization, and address. Please ensure that the organization name and EIN (Employer Identification Number) match exactly as the IRS has them in their system. Next, select the tax year for which you are filing the return. Please check any of the additional questions if they apply to your organization. Then, choose your organization's formation date and the state in which your organization operates. On the following page, select your organization type and whether it operates as an exempt foundation. You will then choose the accounting method that your organization follows. After providing all the necessary information, review carefully to ensure accuracy. If any changes need to be made, click "Edit" to update them. Proceed to file your return based on your data entry. Our tax experts will verify that the 990-PF is the best option for you. Our interview process will guide you step-by-step, and at the end, you will receive your completed 990-PF. Attached below is an overview diagram of our tax process. As you go through the interview, you will be guided through various questions where you can input your tax data. To complete your taxes for the current year, you will need your organization's most recent audited financial statement, a list of officers, directors, trustees, and key employees, and any documents containing...

Award-winning PDF software

990-pf 2025 Form: What You Should Know

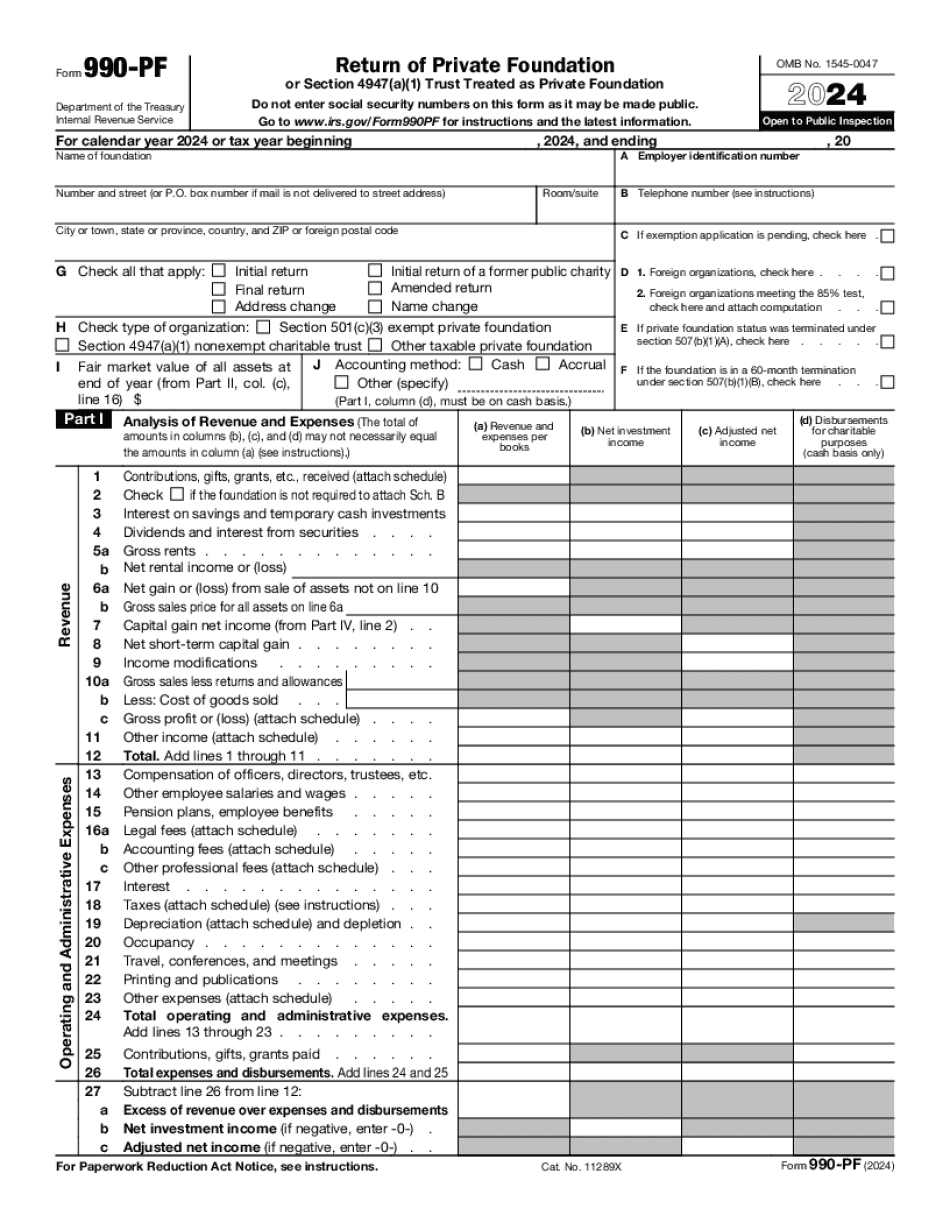

Find out About IRS Exempt Organizations (EO) and Form 990 (990), Free IRS Form What is 990-PF? Exempt organizations must file a tax return called a Form 990 with the IRS each year to comply with federal regulations. The annual report must include information including IRS Form 990 Finder | Research and verify nonprofits — Candid If the name of the organization is very obvious like the name of your church or a non-profit charitable foundation, or if it is a private foundation or trust, it's probably a Form 990-PF (which stands for Publicly For more information about 501(c)(3), see Charities and other tax-exempt entities for more information about Form 990-PF, see Form 990-PF, and for more information, see Form 900, Business Entities Report — IRS For Tax Year 2016, IRS Revenue Ruling CR-68-20, Establishing an Internal Revenue Code Exemption, requires you File IRS Form 990-PF with IRS if your organization qualifies. For More Information... Go to Form 990PF. 2 Research and verify What's a Private Foundation or Trust? A private foundation (also known as a “charity” or “civic organization”) is a separate organization, separate and apart from the regular operations of a corporation or business entity. Form 990 PF (Private Foundation), Form 990-PF, and Forms 990 and 990-PF are one and the same tax form. The form is filed with the IRS, and the organization's return is required. Form 990PF is a private foundation. You can only use this form if your organization qualifies as a private foundation. It is designed for use only by private foundations, and by their donors. Tax-Exempt (EIN: A. IRS 501(c)(3) B. IRS 501(c)(5) C. IRS 501(c)(3) — Note For a nonprofit organization, see If the name of the organization is very obvious, like the name of your church or a Non-Profit Charity (NPC), or if it is a Private Foundation, it's probably a private foundation, not a public habitability or an exempt organization.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 990-PF, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 990-PF online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 990-PF by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 990-PF from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 990-pf 2025