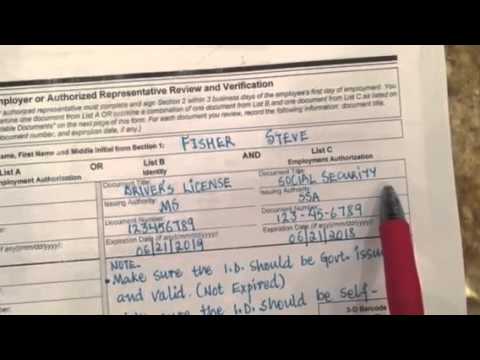

Hello managers in this video I will be showing you how to fill out a I nine form please please please make sure that you do it right we're going to start with the patient number one well it's really page number seven page number seven is the first page which employee the new employee that we hire he fills that out you see it says employer completes the next page this page must be filled by an employee so I'm going to go through it this is an example last name of employee we'll go right here first name we'll go right here middle name we'll go right here any other names they have use we'll go right there the address we'll go right here art my number if any city state zip code and again this is just an example these addresses names are all fake data birth is this this is employee social security number this is their email address this is their phone number and being in Mississippi everybody just about as US citizens so they will check right here citizen of the United States and only thing employee got to do sign it and date it this part down here it's for translator is for someone who doesn't speak English which in our business everybody speaks English and all of them are US citizens so again only thing employee got to do just fill this thing out mark he's a citizen if he is a citizen then sign it and date it his job is complete that's all he's just going to turn the space to you now we're going to move forward with page number eight really page number two which employer Phil sees this employer or authorized represent a review and further verification...

Award-winning PDF software

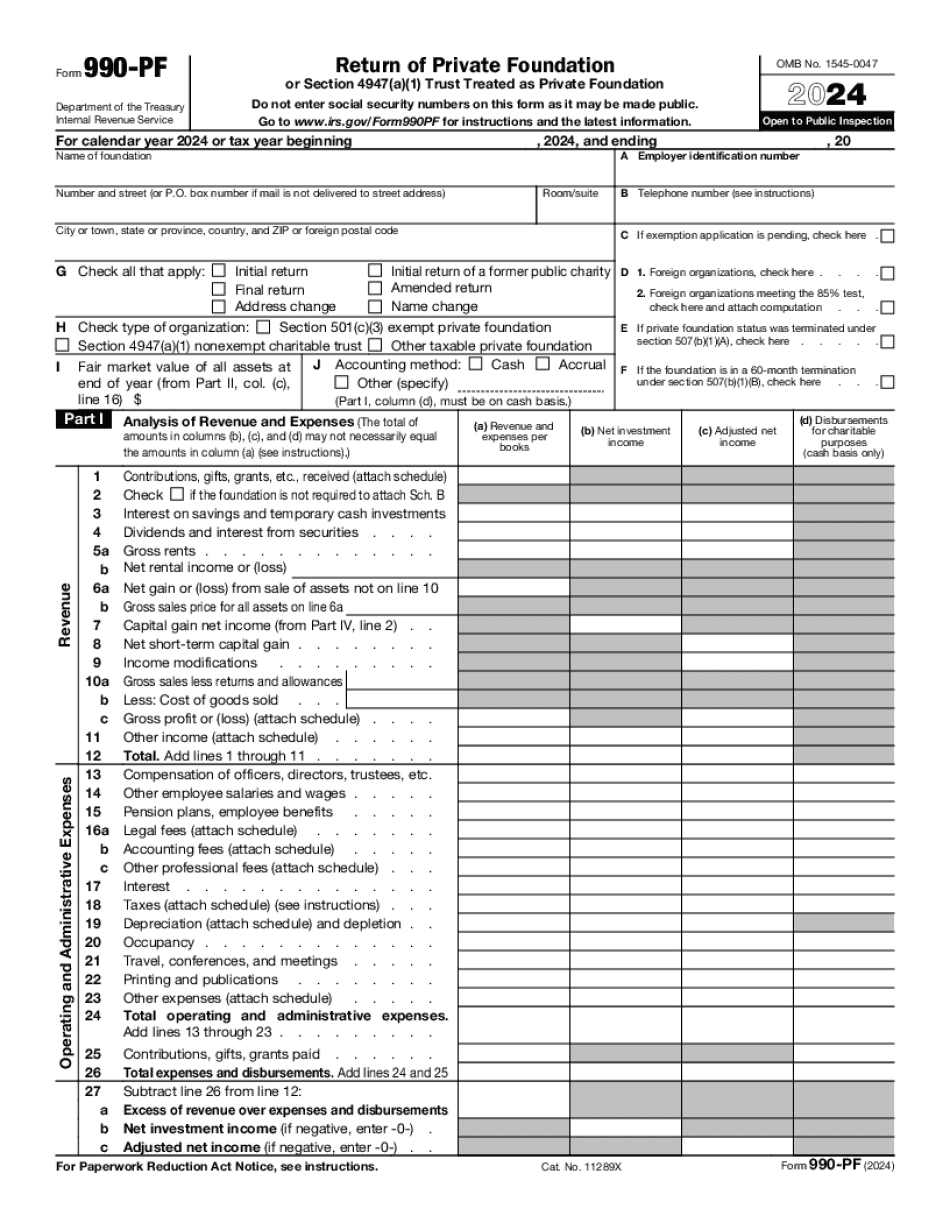

What is 990-PF Form: What You Should Know

Form 990PF — IRS Form 990PF, and Schedule C — Internal Revenue Service. Foundation Search .gov Return of Foundation from Form 990PF. For further information see: IRS Publication 990, Private Foundation, or Foundation Search .gov How to file a Form 990 or 990-PF You file your Form 990-PF (Return of Private Foundation), by completing Form 990PF and submitting it to the IRS. The IRS sends the information to a federal office (Internal Revenue Service) in the department for which you are auditing. An additional 120.00 for additional information, and a 250.00 penalty if you do not pay within the prescribed time, and you file Form 990-PF. You are not required to pay the penalties if you pay the money within 10 days. How much does your organization need to file a Form 990? If your organization is subject to more than one section 501(c)(3), you are required to file Form 990-PF for each segment of your business and to separate any information you have on Form 990-PF. In the aggregate, how much do you have to file? Form 990 or Form 990-PF? Form 990-PF, is required to be filed for every fiscal year your organization's gross receipts in excess of 50,000 are reported as tax-exempt contributions by an organization. Your organization must file Form 990-PF for each segment you receive, and you have to file it by February 28th of the tax year. Your Forms 990PFs and 990-PF must be filed with the same form 1040. Form 990-PF also is required to be filed with Schedule C and not with Schedule B of the 1040. There is no specific requirement for Form 990-PF, but it would be very useful to have it. The IRS has created a form called Form 990PF for private foundations in order to help them file. The filing requirements for foundations are extremely exact which allows them to easily comply with the tax-time filing procedures. The IRS considers a private foundation to have been established if the following are true: Your income arises from the operations of your foundation. You are a sole proprietor. Your foundation is not a partnership. The organization is not organized as a corporation, firm, or partnership.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 990-PF, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 990-PF online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 990-PF by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 990-PF from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing What is Form 990-PF